Nimble-footed UAE and Middle East asset managers are making a quick switch to bonds for investments, riding on the current upward momentum in their yields, as fund managers turn their focus on the potential path for interest rates rather than the outcome of Tuesday’s US election alone, investment experts said.

The strategic move comes in the wake of growing recognition among fund managers that the near-term risk needs to be balanced by the longer-term outlook for the US and global growth.

Regional asset managers and investors are also cherry-picking shares of select energy and technology sector companies, positioning their portfolios to be resilient regardless of the outcome of the Harris-Trump photo-finish ballot battle.

“While the US presidential election can create short-term volatility, longer-term trends are likely to be defined by the achievement of a soft landing in the US economy,” Manpreet Gill, Chief Investment Officer for Africa, Middle East and Europe at Standard Chartered Bank’s Wealth Solutions, told Arabian Business.

“The rise in US bond yields is an area where investors are considering taking advantage of the opportunity presented by higher yields, with a greater focus on the potential path for interest rates, rather than the US election outcome alone,” he said.

Market players said beyond the US elections and interest rate path, Middle East investment strategies are also influenced by factors such as oil prices, regional sustainability agendas, and the diversification push across the GCC region.

‘Trump trades’ gain currency in the short-term

Gill said with the US election so close, Middle East investors are monitoring the race carefully, though there is growing recognition that this near-term risk needs to be balanced by the longer-term outlook for the US and global growth.

He said investors in the region are likely closely following signals from both polls, which show the US presidential election race is very close, and online marketplaces which are increasingly favouring a Trump win.

“Short-term, there has been interest in potential ‘Trump trades’, given this is a relatively more disruptive outcome for financial markets, compared with a Harris outcome which favours the status quo,” the investment expert with Standard Chartered Bank said.

Examples of ‘Trump trades’ include gold, the aerospace, defence and energy equity sectors and the US Dollar.

“Of course, this is balanced by an equal interest in how much of such an outcome is already priced in. We’d argue many Trump trades now price in a Trump win scenario, but pockets of opportunity still exist in US small caps or the industrial sector,” he said.

Gill also pointed out that gold is also seeing significant interest right now, as it offers one option as a hedge to help mitigate election volatility in other major asset classes.

“However, we like the precious metal for other reasons as well – central bank demand remains robust and we expect interest rates to gradually move lower. Both of these are likely to be well supported by longer-term drives as well,” he said.

Vijay Valecha, Chief Investment Officer at Dubai-based Century Financial, said the precious metal could rally further, especially if the result is contested.

Many political observers in the US, as also elsewhere, anticipate heightened chances of post-poll clashes in the US, with Trump resorting to a volley of ‘dark’ threats and his campaign allegedly pedalling a spate of electoral misinformation, especially in swing states, in the last lap of his election rallies.

“Gold is trading in positive territory today after its two-day losing streak last week, as US elections loom around the corner, and no clear winner seems to be in sight,” Valecha said.

He said the market is also focused on the Federal Reserve meeting on Thursday, November 7, and is now pricing in a 99.8 per cent probability of a 25-bp (basis point) rate cut.

“This is expected to further be bullish for gold,” Valecha said.

The yellow metal is currently at $2,736 an ounce.

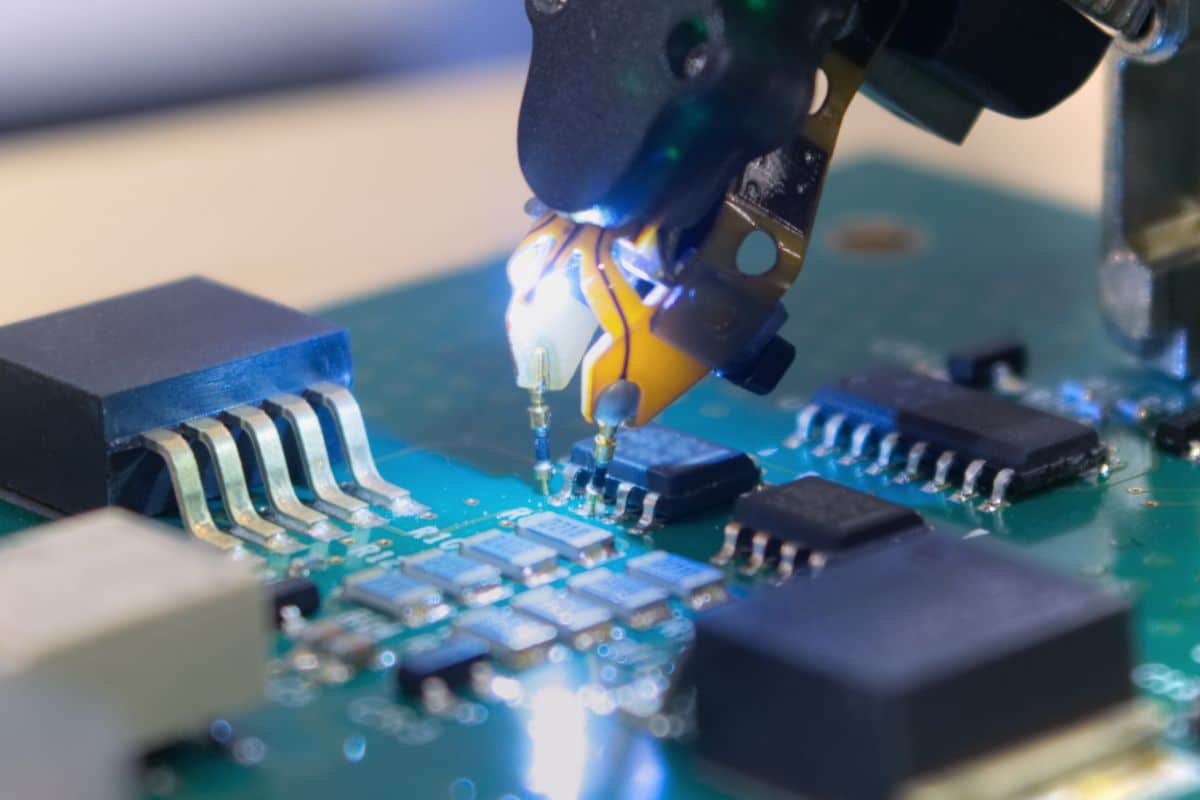

Rising US-China bickering on high-tech transfer

Market experts said how the ripple effects of the recent US decisions to impose restrictions on the transfer of technologies by US companies in a slew of high-tech areas will impact global financial markets and industries is another growing concern for investors.

There are also apprehensions on the potential for retaliatory measures from China, which could further strain economic and diplomatic relations between the two countries, leading to a more fragmented global investment environment, they said.

The recently finalised US rules are aimed at limiting investments in critical technology sectors in China, such as artificial intelligence, on national security grounds.

The measures follow President Joe Biden’s executive order last year targeting investments in semiconductors, microelectronics, quantum computing, and certain AI capabilities.

The US move is also feared to encourage other nations to adopt similar measures.

“These restrictions are likely to be felt across global financial markets and industries, as US companies involved in the production and development of advanced technologies will need to navigate these new regulations carefully, balancing their business interests with national security considerations,” Mohamed Hashad, Chief Market Strategist at Dubai-based Noor Capital, told Arabian Business.

“Looking ahead, the implementation of these investment restrictions and the ongoing trade and technology tensions between the US and China will likely shape the global economic landscape for years to come,” he said.

Hashad said businesses and investors will need to stay informed and adaptable as they navigate this evolving environment.

“The broader implications of these policies on innovation, international cooperation, and economic growth will be closely watched by policymakers and industry leaders worldwide,” he said.