Countries in the Gulf have generally lower levels of inflation compared to the rest of the world.

According to the International Monetary Fund, inflation specifically in the UAE is expected at 3.7 percent this year, before it softens to 2.8 percent the following year.

Business conditions in the UAE and Saudi Arabia also improved in July as price pressures edged slightly lower and employment expanded.

The 16th edition of the Arab Economic Outlook Report released by the Arab Monetary Fund (AMF) back in April added that some inflationary pressures are expected to emerge over the forecast horizon due to the anticipated increase in aggregate demand levels; the rise in consumption tax rates in some Arab countries, the depreciation of some Arab currencies against major currencies, and the impact of other inflationary factors that vary from one Arab country to another.

Additionally, Dubai’s consumer inflation rose to 4.6 percent in April, when compared on a year-on-year basis. This was the highest reading since May 2015, according to a report from Emirates NBD.

For the month-on-month figure, consumer prices rose 1.2 percent, the biggest monthly increase since January 2018, according to new data from the Dubai Statistics Center.

“The biggest challenge facing UAE non-oil businesses is inflation,” said David Owen, economist at S&P Global.

“While the latest results pointed to a softer upturn in overall input costs, the rate of increase was nevertheless the second-strongest in four-and-a-half years amid global shortages of inputs and greater prices for fuel, materials and shipping.”

Here is a complete overview of current inflationary pressures and measures in the UAE, along with expert insights:

- Inflation sparks concern among UAE consumers

- Consumer inflation on a seven-year high: Report

- Record inflation triggers radical responses from central banks: Expert insights

- UAE Central Bank raises interest rates to curb inflation

- UAE introduces inflation allowance for citizens: Benefits 47,300 families

- UAE residents cut spending as inflation continues meteoric rise

- Retailers and restaurants reveal strategy to buffer inflation

Inflation sparks concern among UAE consumers

Two-thirds of consumers in the UAE are “somewhat or very concerned” about rising inflation, according to a new survey, but overall spending was up 22 percent in the first half of the year.

The January to June period saw a 16 percent growth in retail spending, as well as a 31 percent increase in non-retail sectors, the new UAE Retail Economy report by Majid Al Futtaim (MAF) showed.

Its chief executive Alain Bejjani said he expects the positive trajectory to continue “despite the gathering global headwinds.”

“While the country is not immune to wider macroeconomic challenges and inflationary pressures, the intrinsic strength and stability of its foundations offer fertile ground for lasting economic growth,” he explained.

Countries in the Gulf have generally lower levels of inflation compared to the rest of the world. The International Monetary Fund earlier said inflation in the UAE is expected at 3.7 percent this year, before it softens to 2.8 percent the following year.

The recent MAF report showed muted price gains in the country have allowed consumers to continue splurging cash.

General retail category was up 15 percent in the first half of the year, driving a huge chunk of the overall retail growth. Spending on food and beverages was up 15 percent, followed by spending on hotels (14 percent) and healthcare (14 percent).

Although spending was generally up, the MAF report also showed that people are spending less on recreational activities, tourist attractions, and restaurants.

MAF, which operates 29 shopping malls across the region as well as the supermarket chain Carrefour, said consumer purchases in supermarkets have shifted towards “lower value and higher frequency,” as average transaction value decreased by 12 percent compared to the first half of 2021.

The report said consumers are “buying more discounted products as a result (of rising prices due to inflation), as well as stocking up and focusing on essentials.”

Footfall to malls also increased in the first half of 2022, according to the report, with MAF shopping malls recording a 15 percent rise in physical visitors. But online shopping still emerged as a more popular medium – with e-commerce spending jumping 41 percent in the same period, compared to last year.

Consumer inflation on a seven-year high: Report

Dubai’s consumer inflation rose to 4.6 percent in April, when compared on a year-on-year basis. This was the highest reading since May 2015, according to a report from Emirates NBD.

For the month-on-month figure, consumer prices rose 1.2 percent, the biggest monthly increase since January 2018, according to new data from the Dubai Statistics Center.

Khatija Haque, Head of Research and Chief Economist at Emirates NBD, said: “The main driver of inflation in Dubai in recent months has been transport costs, which were up 28.8 percent year-on-year in April, accounting for around half of headline inflation.

“Food prices (8.6 percent higher year-on-year) were the second biggest driver of inflation in April, followed by recreation and culture costs and restaurant and hotel prices.”

The only component of the CPI basket which declined on an annual basis in April was housing and utilities. However, even here the rate of decline has slowed and Emirates NBD expects housing inflation in the CPI to turn positive in the coming months.

“We maintain our forecast for UAE inflation to average 4.3 percent in 2022 as higher food, housing and services costs feed through to the CPI, even as a stronger dollar helps to keep goods inflation contained.”

The Dubai Statistics Center re-based the time series to 2021 (from 2014 previously) and as a result, the weights of the components making up the consumer price index (CPI) have changed.

The biggest revisions were to the weights of housing (down) and education (up). Housing now accounts for 40.68 percent of the CPI basket, down from 43.70 percent previously.

Education now accounts for more than 8 percent of CPI, double what it did before. A new category for “insurance and financial services” has been introduced into the CPI basket, which was likely previously included in “miscellaneous goods and services”, with a weight of 1.26 percent.

Record inflation triggers radical responses from central banks: Expert insights

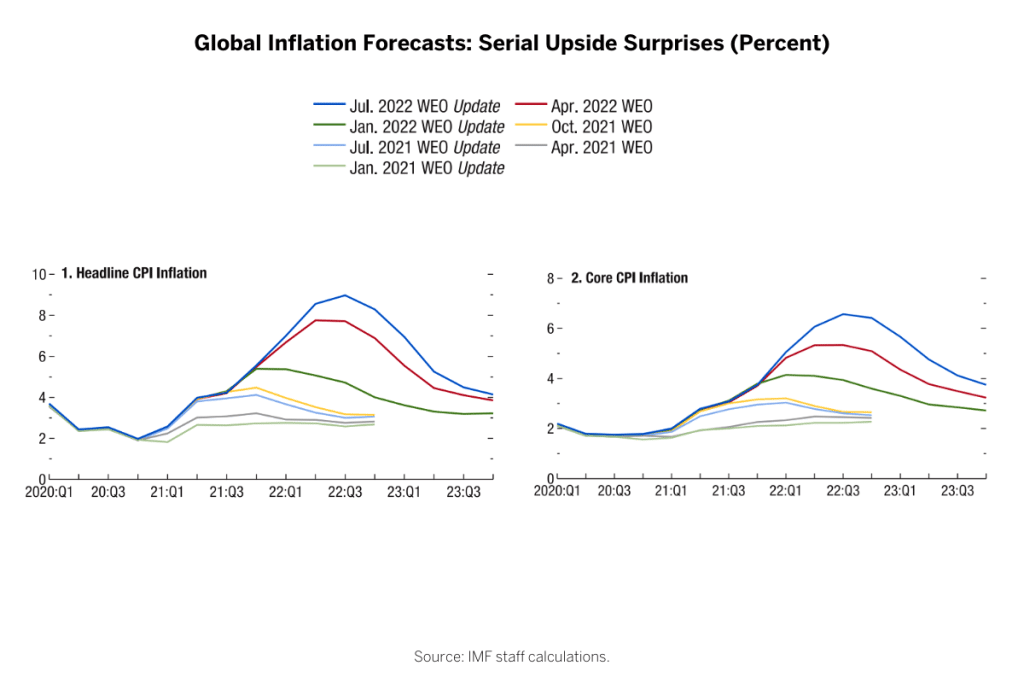

The first half of 2022 has simply been one of the worst in the history of markets. Today we’ll look back at what happened, and of course share our perspective for what’s next, says Maurice Gravier, chief investment officer at Emirates NBD.

Back in January, our 2022 Global Investment Outlook was titled “Low Visibility Ahead”. Between high inflation, slowing growth, and the beginning of the end of magic money, we had more questions than answers for the year ahead. We were however not outright bearish, as we thought that the recovery still had legs, and that inflation was about to start normalising. Bottom-line, our key message was to expect volatility and to be more reactive than proactive.

A lot happened. The conflict in Ukraine: it amplifies inflation, especially through commodities, and it darkens the outlook for growth with the double-edged sword of sanctions for Russia. If that wasn’t enough, China went through a severe Covid outbreak and an even more severe response, which added pressure on global supply chains. The result: inflation hasn’t normalised, forcing central banks to go ballistic in fighting it at all costs.

It’s important to point out – With no inflation for decades, central banks used to be markets’ best friends, supporting growth and financial stability. Things have changed. The battle against inflation is their existential mission, while the others have become secondary.

The Fed chairman said it is “unconditional” and the BOE governor said there are “no ifs and buts”. Price pressure is about high demand meeting constrained supply. Central banks can’t influence supply: their only tool is to make money more expensive to slow down activity and pressure demand. They have now raised rates at the steepest pace in recent history and withdrawn liquidity. Whatever it takes? Or whatever it breaks?

This is a terrible combination for investors. Inflation and higher interest rates directly affect bonds and pressure equity valuation multiples. Meanwhile, growth scare questions the trajectory of corporate earnings and the solvency of issuers. There is nowhere to hide: 2022 so far is a crash of everything, with every single segment of both fixed income and equity down between -15 percent to -20 percent.

Meaning of stagflation:

Indeed, the June consumer price index in the US came out this Wednesday at an eye watering +9.1 percent year-on-year, an acceleration from May and a higher number than forecast. It means that the Fed could hike by more than 75 basis points later in July, which in turn will threaten growth further.

To that extent, the IMF cut its 2022 real GDP growth forecast for the US, from 2.9 percent to 2.3 percent, and expects only 1 percent next year. The European Commission did the same, trimming their projections to 2.6 percent this year and 1.4 percent in 2023. Are we about to hit the wall of stagflation?

We don’t think so. These institutions are not known for their blissful optimism, and it’s worth noting that their revised growth numbers remain positive. So far, the global economy has been very resilient, with record low levels of unemployment in particular.

Of course, a recession is possible, especially in Europe, but we firmly believe that our inflation problem would also vanish under this scenario. And policy responses would dramatically change, especially given the stellar levels of debt in the system – not to mention political turbulence.

We don’t think so. These institutions are not known for their blissful optimism, and it’s worth noting that their revised growth numbers remain positive. So far, the global economy has been very resilient, with record low levels of unemployment in particular.

Of course, a recession is possible, especially in Europe, but we firmly believe that our inflation problem would also vanish under this scenario. And policy responses would dramatically change, especially given the stellar levels of debt in the system – not to mention political turbulence.

Crucially, lower valuations on all asset classes now discount a substantial economic risk – which could materialise, or not. Investor sentiments follow suit with record levels of pessimism: markets are not ready for good news, and it is interesting to see that after risk assets initially dropped when the US CPI came out, most recovered to close only slightly lower.

You have guessed it: we believe that the medium-term outlook is not adverse. Between base effects and central banks’ actions, inflation should start to normalise, but not to the 2 percent we were used to. Current levels are probably at their peak, which should halve at some point. That should be enough to justify a pause in tightening and providing relief to markets. The question is probably not if, but when.

Since the timing is the key unknown, we have two messages for the near future. First, volatility should remain extreme in the coming months – until we see the only true catalyst for sustainable market recovery, which is, again, convincing evidence that inflation is abating. We expect sudden and unpredictable corrections and rallies, which means that short-term speculation and leverage are dangerous games.

Second, the medium-term perspectives are reasonably constructive, as risks are adequately priced-in and sentiment is very pessimistic. We may be wrong of course, but we are prepared to increase exposure, should another severe correction happen.

This is the positioning we currently recommend in our tactical asset allocation. Cash doesn’t compensate for inflation, but it absorbs shocks and provides flexibility; we are close to neutrality. We are still underweighting fixed income, especially on its riskiest segments: some spreads are a bit complacent with the economic risk.

By contrast, government bonds are becoming more compelling: we have cut our underweight and recommend being opportunistic when rates overshoot. Within equities, we are neutral on developed markets but overweight on emerging ones – China has a very different dynamic as we discussed last month in this column. We also keep on favouring UAE stocks and find opportunities in India.

Finally, we overweight alternatives due to their very different sensitivities to both inflation and growth.

Investment is a long-term game, and patience is required more than ever. Stay safe.

— Maurice Gravier, chief investment officer at Emirates NBD.

UAE Central Bank raises interest rates to curb inflation

Central banks of the UAE, Bahrain, Kuwait, Qatar, and Saudi Arabia have raised their borrowing rates, following the same decision from the US Federal Reserve.

The Federal Reserve announced a consecutive 0.75 percentage point interest rate hike – in a bid to rein in inflation and avoid recession.

In the UAE, the central bank raised its benchmark base rate for its overnight deposit facility (ODF) by 75 basis point.

“The CBUAE also has decided to maintain the rate applicable to borrowing short-term liquidity from the CBUAE through all standing credit facilities at 50 basis points above the Base Rate,” a statement on WAM said.

It added: “The Base Rate, which is anchored to the US Federal Reserve’s IORB, signals the general stance of the CBUAE’s monetary policy. It also provides an effective interest rate floor for overnight money market rates.”

According to central bank data, inflation in the UAE could reach up to 5.6 percent this year. Already in the first quarter, the consumer price index was up 3.4 percent compared with previous quarters.

The Saudi central bank announced a similar decision, raising its repurchase agreement rate by 75 basis points to 3 percent from 2.25 percent, as well as its reverse repurchase agreement rate from 1.75 percent to 2.5 percent.

The US move was the Federal Reserve’s fourth interest rate increase in four months, and its chairman Jerome Powell said any further hike in September would depend on data and hinted at slowing the pace of hikes.

“As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation,” he commented.

The Fed chairman added he did not think the economy was in recession, even though growth was negative in the first quarter.

“Think about what a recession is. It’s a broad-based decline across many industries that’s sustained more than a couple of months. This doesn’t seem like that now,” Powell said.

“The real reason is the labour market has been such a strong signal of economic strength that it makes you question the GDP data.”

Stocks rallied on Wednesday after the announcement and Powell’s comments. The Dow Jones Industrial Average jumped 436.05 points, or nearly 1.4 percent, to 32,197.59. The S&P 500 gained 2.62 percent to close at 4,023.61 and the Nasdaq Composite climbed 4.06 percent to 12,032.42.

Tech shares led gains a day after good quarterly results from Alphabet and Microsoft. It is expected to fall after Meta posted its first quarterly loss results on Thursday.

Shares in the Asia-Pacific region followed suit. The Kospi in South Korea was up 0.66 percent, while the S&P/ASX 200 was 0.43 percent higher in Australia. The Shanghai Composite gained 0.21 percent while the Shenzhen Component was 0.2 percent higher. Japan’s Nikkei 225 was flat.

While the fed funds rate directly impacts what banks charge for short-term loans, it also affects consumer products such as adjustable mortgages, auto loans and credit cards.

UAE introduces inflation allowance for citizens: Benefits 47,300 families

Around 47,300 families have claimed the inflation allowance, launched last month by the UAE government for low-income Emirati, according to data from the Ministry of Community Development (MoCD).

The new allowance provides a monthly subsidy of 85 percent of the fuel price increase over AED 2.1 per litre, state news agency WAM has reported.

The move is part of the UAE president’s directive to restructure its social welfare programme for low-income Emiratis, effectively doubling its size to AED 28 billion.

According to the new fuel subsidy scheme, the head of a family will receive a monthly subsidy of 300 litres, while working wives will receive a subsidy of 200 litres.

The inflation allowance will also provide food, electricity, and water subsidies, the report showed.

The government will bear 75 percent of food price inflation for eligible Emirati families, and will provide a monthly subsidy of 50 percent for specific electricity and water consumption quotas.

The reformed social welfare programme now has a provision of AED 5 billion for annual social support allocation, compared to the previous AED 2.7 billion, according to the new directive.

Other types of allowances will be introduced as well – including housing (up to AED 2,500) and university (up to AED 3,200) stipends, as well as allowances to unemployed citizens – both job seekers (up to AED 5,000 for six months) and those over the age of 45 (up to AED 5,000).

In the previous programme, there were three allowances allocated to Emirati families – for the head of the family, the wife, and the children. The reform is set to increase these allowances, where a family member could get up to AED 13,000 per month.

UAE residents cut spending as inflation continues meteoric rise

UAE residents brace for higher cost of living and continue to make cutbacks to their household spending as global inflation is forecast to reach 7.9 percent globally.

The vast majority, 83 percent, of UAE residents said their cost of living has gone up compared to 12 months back in the latest YouGov Realtime study.

As inflation bites into household budgets across the world, the top areas where UAE residents intend to make cutbacks are on eating out at F&B outlets (47 percent), clothes/apparels (43 percent).

The rising costs have made residents cut back on their spending with 40 percent spending less on gadgets and electronics, while 32 percent spend less on F&B takeaways and 27 percent on non-essential food items. Grooming services (26 percent), overseas holidays (25 percent), and leisure activities (25 percent) are also likely to take a hit in the upcoming six months.

Despite steep costs, 39 percent of residents hope their financial situation to be better in the future compared to 21 percent who anticipate their financial situation to worsen and 27 percent expect it to remain unchanged.

Retailers and restaurants reveal strategy to buffer inflation

The global economy is beset by challenges caused by skyrocketing inflation. With pressure rising in the Gulf, retailers are scrambling to shelter customers from unwanted price hikes.

In response to high inflation, the US Fed recently decided to raise interest rates, and central banks in the GCC immediately followed suit. These moves came as the prices of key commodities continue to rise, including in the food sector, while supply chain challenges further confound retailers.

The Gulf relies heavily on food imports, and, in recent years, has rolled out aggressive initiatives to boost its local manufacturing capacity, with a special focus on developing local logistics and food and beverage ecosystems.

While these government-led policies could help in the long-run, retailers should revisit their internal systems to cope with the rising price of raw materials, an analyst from global consultant Kearney said.

“Inflationary environments have always been a great time for consumers to discover new brands and reward retailers providing the right value proposition,” Mohammed Dhedhi, partner at the consumer and retail practice at Kearney Middle East, told Arabian Business.

Consumer behaviour, he added, is already changing, with UAE consumers seeking “more value products and questioning the utility of their recurring purchases.”

“Price remains the key factor in consumer purchase decisions in the UAE. While some costs are non-discretionary like mortgages on housing and cars, several costs that have risen are discretionary and recurring and now must be factored into weekly and monthly budgets vs one-off expenses,” Dhedhi explained.

One aspect retailers could improve on is their cost structure, the Kearney partner said, beginning with improving their understanding of price increases passed on by suppliers.

Retailers can “implement efficiency measures internally and jointly with suppliers, evaluate product sets for substitutes, and identify what value-centric products can be introduced, or even reconsider product specifications,” Kearney’s Dhedhi said.

Another strategy is to reconsider purchasing agreements, he added, this time focusing on optimising contracts with suppliers.

“This can include reviewing purchase volumes to drive efficiencies and reducing wastage, reviewing contract terms to optimise working capital and margins, evaluate alternate suppliers, negotiate great and more specific promotion support from suppliers, and review transport and other supply chain-related costs for alternatives and greater efficiency opportunities,” Dhedhi said.

These strategies are especially true for restaurants, whose relationship with suppliers are critical to ensure the businesses’ good performance.

Razielle Majareis, a project manager with three decades of experience in the UAE’s food and beverage sector, said restaurants normally have provisionary efforts to buffer the blow of increasing food prices.

“Ultimately increasing the price of the menu should be the last resort, because restaurants need to make sure they don’t lose their customers,” she told Arabian Business.

She said there are numerous ways for restaurants to protect customers from inflation-led price hikes, including different pricing strategies that are resilient to spontaneous market fluctuations.

“When restaurants do menu analysis for pricing, they already consider the possibility of price fluctuations – so when it happens, consumers are protected. Pricing only usually changes every six months to a year, and when it does, it’s usually negligible, Majareis explained.

The food and beverage expert said more obvious strategies to circumvent price fluctuations include introducing new dishes on the menu, creatively sourcing raw ingredients, and negotiating good deals with suppliers.