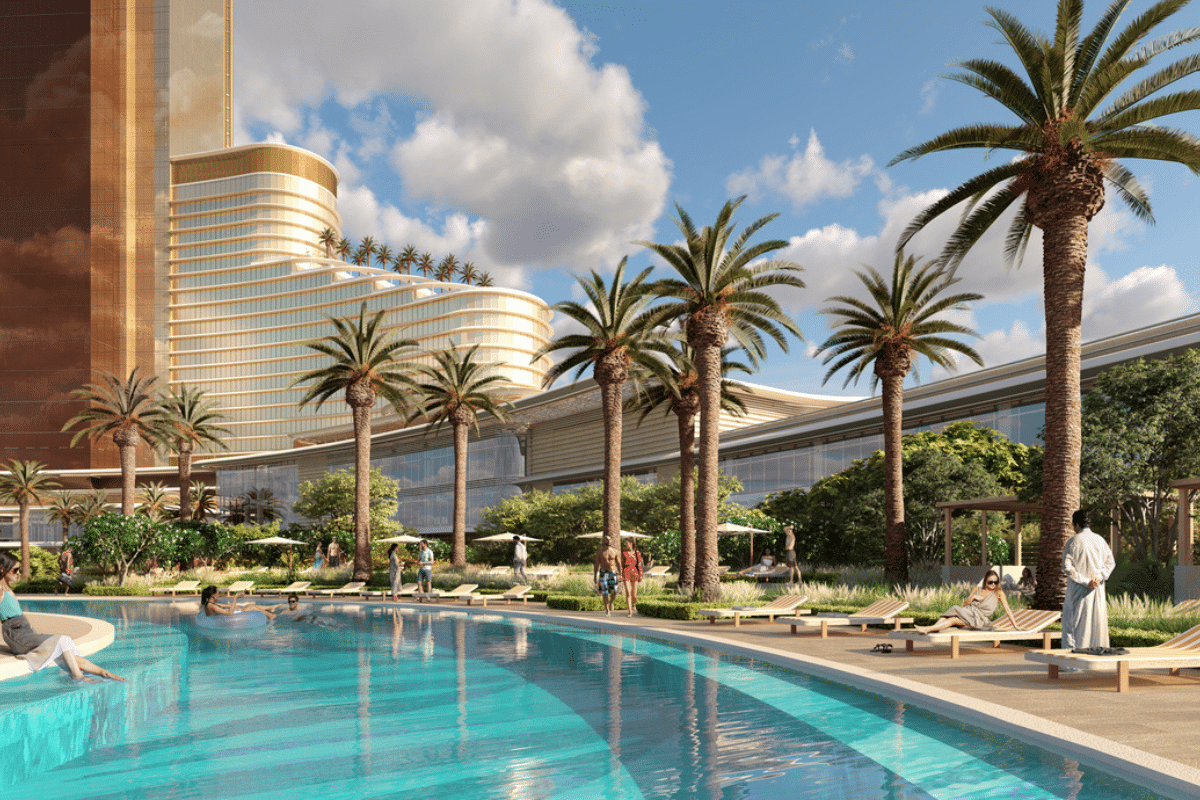

In the evolving landscape of UAE real estate, Ras Al Khaimah has been experiencing a real estate boom driven by a combination of factors including the much anticipated Wynn Al Marjan casino resort.

“The announcement of Wynn Al Marjan Resort has significantly boosted real estate demand in RAK,” Maxim Novikov head of the RAK branch at Metropolitan Premium Properties told Arabian Business.

According to Novikov, the RAK real estate market is poised for significant growth, with property prices projected to rise by 10-15 per cent in 2024. This follows a staggering 50 per cent increase in 2023, demonstrating the area’s potential for lucrative investment opportunities.

RAK market evolution: A rapid boom

He emphasises that “the time to act is now,” as the opening of the gaming resort could push prices up an additional 50 per cent.

“The surge in property prices in Ras Al Khaimah reflects the growing attractiveness of the emirate as a real estate investment destination. With ongoing developments and increasing demand, we anticipate prices to rise by 50 per cent by the time the casino opens. For investors looking to take advantage of the market the time to act is now,” Maxim Novikov, head of the RAK branch at Metropolitan Premium Properties said.

The upcoming Wynn Al Marjan Resort, set to be a luxurious addition to RAK’s hospitality landscape. This development, set to open in 2027, is expected to have a profound impact on the local economy and real estate market.

Industry experts believe that the Wynn resort will not only enhance RAK’s appeal as a tourist destination but also drive property demand as investors seek to capitalise on the influx of tourists and potential residents.

Novikov describes the resort as a “prestigious brand” that has attracted both local and international investors. “This influx is not only boosting property values but also enhancing rental demand and stimulating development activity,” he said.

A surge in international investors

The resort aims to attract millions of visitors annually, fostering a surge in demand for both short-term accommodations and long-term residential properties.

“The resort will drive tourism and elevate RAK’s profile as a desirable destination for living and investing,” Novikov said.

The RAK market is seeing a surge in interest from international investors, particularly from the US, UK, Europe, and the Commonwealth of Independent States (CIS). “We are also noticing growing interest from India, Pakistan, and Southeast Asia,” Novikov explained, indicating a broadening appeal for RAK as a prime investment destination.

This increased interest is reflected in various segments of the market, including luxury villas, apartments, and commercial spaces.

Real estate investment hotspots in RAK

According to MPP, the most sought-after areas at the moment include Al Marjan Island, Mina Al Arab, and Al Hamra Village, with projects featuring private beaches seeing the highest demand.

The pace of new property launches has been brisk, approximately two new projects debut each week, offering a diverse array of options for investors, from luxury branded residences to more affordable units.

Demand for smaller units, such as studios and one-bedroom apartments, is particularly strong, driven by investors seeking short-term rental opportunities. Novikov highlighted, “Studios and 1-bedroom units are experiencing the highest demand, driven by investors seeking lucrative holiday and short-term rental opportunities. Prices of studios have jumped on average 10-15 per cent in the last quarter, while one-bedroom units have seen a rise of at least 5-10 per cent.”

“Larger properties are also attracting significant interest. Branded apartments, three-bedroom units and waterfront villas priced at AED 7 million and above are popular choices for buyers seeking personal residences or secondary holiday homes,” he added.

Despite the promising growth, Novikov cautioned about several challenges that could impact the market’s sustainability.

“When a market experiences such rapid growth, challenges will arise,” he alerted. For instance, some developers are offering less flexible payment plans, often requiring high upfront payments during the construction phase. “This lack of flexibility can deter potential buyers.”

Infrastructure development is another area of concern. “The rapid expansion of residential developments has outpaced the growth of essential infrastructure and social amenities such as hospitals, schools and shopping malls,” he said.

This disconnect can affect the quality of life for residents, although he expressed confidence that, as seen in other markets, infrastructure development usually catches up once there is sufficient demand.

Novikov also highlighted a potential imbalance in development focus, “There seems to be a lack of focus on developing commercial properties alongside residential ones.”

He stressed the importance of a balanced mix for creating well-balanced, sustainable, and vibrant communities. However, steps are being taken to address this issue, he cited RAK Central as an example of a mixed-use development that includes a high-rise financial center.

Despite these challenges, the outlook for RAK’s real estate market remains positive, according to industry experts. The continued investor interest, coupled with the transformative impact of the upcoming Wynn Al Marjan Resort, suggests that RAK’s property boom is set to continue.