Petrol and diesel prices in the UAE are set to fall further in September, after consecutive increases in recent months.

Petrol prices are affected by a global increase in crude oil prices, which have sored almost 50 percent to more than $100 a barrel since the beginning of 2022.

The Russia-Ukraine war was one of the key reasons due to the increase, as Russia is one of the world’s largest exporters of oil.

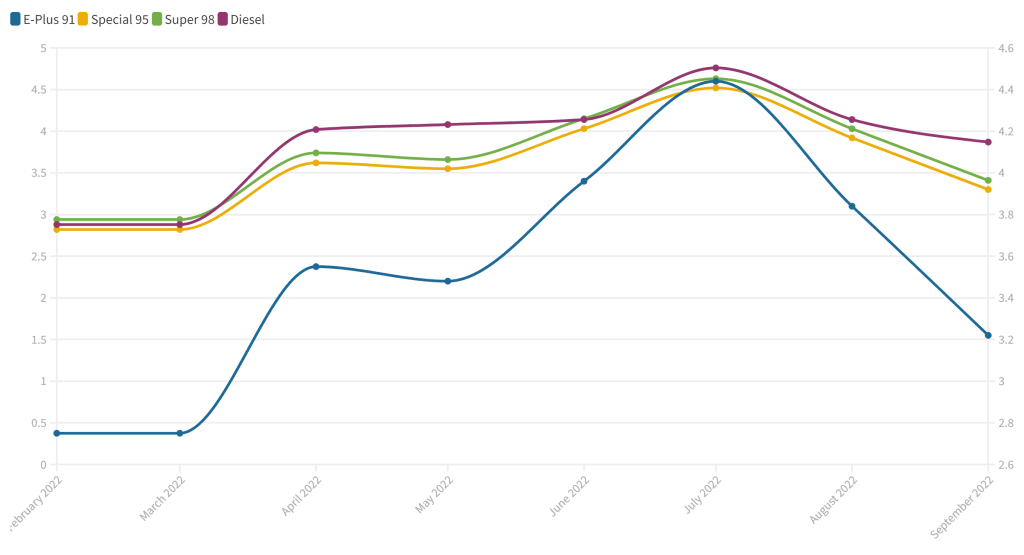

Here is a complete overview of UAE petrol prices so far in 2022:

| Prices in AED per litre | E-Plus 91 | Special 95 | Super 98 | Diesel |

| September 2022 | 3.22 | 3.30 | 3.41 | 3.87 |

| August 2022 | 3.84 | 3.92 | 4.03 | 4.14 |

| July 2022 | 4.44 | 4.52 | 4.63 | 4.76 |

| June 2022 | 3.96 | 4.03 | 4.15 | 4.14 |

| May 2022 | 3.48 | 3.55 | 3.66 | 4.08 |

| April 2022 | 3.55 | 3.62 | 3.74 | 4.02 |

| March 2022 | 2.75 | 2.82 | 2.94 | 2.88 |

| February 2022 | 2.75 | 2.82 | 2.94 | 2.88 |

OPEC+ will next meet on September 5 to discuss market conditions and decide on its future output policy.

Oil prices sank on Tuesday, after securing their highest gains in over a month in the previous session, as inflation overrides possible OPEC+ output cuts.

Brent crude futures for October dropped by 56 cents, or 0.5 percent , to $104.53 a barrel by 0620 GMT, after climbing 4.1 percent on Monday.

US West Texas Intermediate crude was valued at $96.86 per barrel, down 14 cents, or 0.1 percent, following a 4.2 percent rise in the previous session, Reuters reported.

Central banks in the United States and Europe could resort to aggressive interest rate hikes as inflation continues to affect the world’s biggest economies.

“Risk appetite has cooled over an anticipation that the Federal Reserve would continue to increase interest rates…. A pull-back of natural gas prices in Europe also adds uncertainties to the picture of energy crisis,” analysts from Haitong Futures told Reuters.

The UAE is claimed to be aligned with Saudi Arabia’s thinking on crude oil markets, however, an official statement has not been released by the UAE government.

Here’s an overview of the current situation:

- Saudi Arabia should lift cap on domestic petrol prices: IMF

- Kuwait announces hike in crude production

- Rising oil and petrol prices continues to be a concern

- UK records 40-year high inflation amid soaring petrol prices and cost of living

- Rising petrol prices and labour shortages post threat on recovering Middle East aviation

Saudi Arabia should lift cap on domestic petrol prices: IMF

Saudi Arabia should resume letting domestic energy prices rise as part of efforts to reduce consumption and help in hitting reduction targets for emissions, according to the International Monetary Fund.

The world’s biggest crude exporter set an upper limit for the domestic cost of gasoline to soften the impact of higher living costs on citizens last year, just a month before announcing a plan to hit net zero carbon emissions by 2060.

“There is a lot of efficiency that can be gained by removing the existing subsidies,” Amine Mati, the IMF’s mission chief to the kingdom, said in an interview. Saudi Arabia is in a “good position to step up further the energy-price increase which goes in line with the green initiative and the idea of reducing emissions.”

The IMF advice comes as governments around the world are taking steps to contain inflation caused by higher petrol prices and grain shortages.

While soaring crude has created problems for energy importers, Saudi Arabia’s economy is set to grow at the fastest pace in a decade, according to the IMF, thanks to oil’s rise and loosening business restrictions under a diversification plan known as Vision 2030.

Saudi Arabia should continue to focus on targeted social support to help maintain energy price reforms, the IMF said.

Local gasoline prices are among the lowest in the world — around two-thirds that in the US, but they’ve risen since 2015, when the subsidy reform was introduced to promote more efficient consumption and help plug a budget deficit brought on by plunging oil prices.

Today, some Saudis believe that increasing oil prices should actually lead to lower costs at the gas pump because of the boost they provide to government finances. The IMF envisages a budget surplus of 5.5 percent of gross domestic product this year.

Saudi Arabia’s economy is expected to grow 7.6 percent, according to the IMF’s latest projections published on Wednesday, consistent with a previous estimate in April. Inflation is now expected to reach 2.8 percent by the end of the year, slightly higher than the fund’s earlier forecast of 2.5 percent.

“Right now, we think that the 2.8 percent projection is likely going to be an upper bound,” said Mati, “we don’t really expect inflation to be higher than that on average for 2022.”

Unemployment among nationals is seen dropping to just over 10 percent this year, from 11 percent in 2021, according to the IMF’s report.

Earlier this year, Saudi officials said the government will hold billions of dollars from its expected oil windfall in a government current account and only decide how to distribute the money by the end of the fiscal year. The move is an attempt to try and avoid the boom and bust cycles that followed previous periods of high oil prices.

The government’s new approach to dealing with its surplus is a step “in the right direction,” said Mati. “Policy makers have learned from what has happened in the past and I think they are cautious of that going forward.”

Kuwait announces hike in crude production

Kuwait has announced increasing crude oil production in line with its 2.811-million-barrels-a-day quota under the OPEC+ agreement.

Dr. Mohammad Al Faris, Kuwait Deputy Prime Minister, Minister of Oil, Minister of State for Cabinet Affairs, said the move was in keeping with the country’s commitment to ensure secure and stable supplies of oil to the international markets, Kuwait News Agency KUNA reported.

Dr. Al Faris said Kuwait would continue to support efforts to promote market stability, particularly through the OPEC+ forum.

“Since 2020, OPEC+ successfully restored and maintained oil market balance and stability by ensuring adequate supplies to markets,” he said.

Dr. Al Faris, however, warned that structural supply weaknesses caused by years of underinvestment were leading to extremely limited worldwide spare capacity, creating extraordinary volatility in the oil markets at a time when these markets needed stability like never before to allow participants to plan future production capacity increases to meet rising demand.

“Kuwait supports all efforts designed to protect market stability against the recent harmful volatility that threatens to undermine the basic functions of the market,” he said.

Dr. Al Faris said the latest move to increase production was consistent with announcements made by Kuwait Petroleum Corporation (KPC) that it was bringing on line investments to ensure international oil markets are adequately supplied and can meet the expected future demand.

Rising oil and petrol prices continues to be a concern

Global oil prices could reach a “stratospheric” $380 a barrel according to analysts at JPMorgan Chase, reported news agency Bloomberg.

The price of oil could rocket if US and European penalties prompt Russia to inflict retaliatory crude oil output cuts, JPMorgan Chase analysts warned.

Rising oil prices are proving a concern across the world, with motorists feeling the pinch as petrol prices continue to increase.

A 3 million-barrel cut to daily supplies would push benchmark London crude prices to $190, while the worst-case scenario of 5 million could mean $380 crude, the analysts wrote.

Bloomberg reported that the Group of Seven nations are hammering out a mechanism to cap the price fetched by Russian oil in a bid to tighten the screws on Vladimir Putin’s war machine in Ukraine.

However, given Moscow’s robust fiscal position, it can afford to slash daily crude production by 5 million barrels without excessively damaging the economy, JPMorgan analysts wrote in a note to clients.

“The most obvious and likely risk with a price cap is that Russia might choose not to participate and instead retaliate by reducing exports,” JPMorgan Chase analysts wrote.

“It is likely that the government could retaliate by cutting output as a way to inflict pain on the West. The tightness of the global oil market is on Russia’s side.”

UK records 40-year high inflation amid soaring petrol prices and cost of living

Inflation in the UK climbed to a new 40-year high with the Consumer Price Index (CPI) reaching 10.1 percent in July.

This is after inflation peaked at 9.4 percent in June, confirmed by the Office for National Statistics (ONS).

The rise in inflation intensified largely due to increase in food prices, household spending, including surge in market prices of electricity, gas and petrol prices.

Commenting on the rising inflation, Chancellor Nadhim Zahawi said: “Getting inflation under control is my top priority, and we are taking action through strong, independent monetary policy, responsible tax and spending decisions, and reforms to boost productivity and grow.”

Alongside soaring energy prices in Europe and the Ukraine-Russia conflict, inflation has been on the rise ever since the world markets reopened post pandemic.

According to the Bank of England, inflation is expected to peak at 13.3 percent this year pushing UK into a recession.

Earlier this year, Bank of England hiked interest rates by 0.5 percent to 1.75 percent – the highest rate since 2009 to abate the rise in inflation.

Highest since 1982, the surging inflation can mean increase in cost of living, with concerns that low-income residents will be unable to afford to heat their homes this winter.

International Monetary Fund (IMF) has cited high inflation among the reasons for slower world economic growth. The ONS data showed July’s Retail Price Index inflation was 12.3 percent — up from 11.8 percent the previous month and the highest since January 1982.

Financial markets are betting that bank rate will need to reach 3 percent by the middle of next year to tame inflation

Rising petrol prices and labour shortages post threat on recovering Middle East aviation

Labour shortages and rising petrol prices are slowing the recovery of Middle East’s aviation sector, a new report showed.

“Airlines have been at the receiving end with the petrol prices hikes and personnel shortage impacting their bottom-line,” Andre Martins, a partner at Oliver Wyman said.

The report looked at how the global aviation sector is recovering after a challenging last few years due to pandemic-induced mobility restrictions.

In the Middle East, where pent-up demand is particularly high, airlines are faced with manpower issues and higher petrol prices.

The report said labour shortages are felt across different levels – from pilots to baggage handlers and aircraft mechanics.

Passenger volume in the region could reach 98 percent of 2019 levels by 2024, before it exceeds pre-pandemic figures by 2025, according to earlier estimates by the International Air Travel Association (IATA).

The aviation in the Middle East sector has faced pandemic-related pressures, including layoffs, as well as a lower number of newly certified pilots.

Martins, in an earlier statement, said the Middle East could be the one of the first regions to experience a pilot crunch.

“We expect the Middle East to be the region affected soonest by the shortage outside of North America, driven by a projected sharp increase in air travel demand over the next few years, new players entering the market and big tourism developments happening in the region,” he said.

On a more positive note however, the Oliver Wyman executive said the sectoral downturn has paved an opportunity for new market entrants – globally, as well as in the region.

“We have seen multiple airline start-ups just launch or prepare for an upcoming launch such as Akasa Air in India, the proposed new airline in Saudi Arabia, and Avelo in the US, among many others,” Martins said.