The United Arab Emirates is rapidly expanding its economic footprint and soft power influence through an ambitious network of trade agreements and strategic partnerships spanning continents.

This move, set to reshape global trade and diplomacy, has one major underlying goal: business first. At the heart of this strategy lies a series of Comprehensive Economic Partnership Agreements (CEPAs) that have positioned the UAE as a key player in the evolving world order, experts told Arabian Business.

From Latin America to Africa and beyond to Asia, the UAE seems to be weaving a web of commercial ties that extends far beyond its traditional spheres of influence.

This expansive vision reflects a nation determined to diversify its economy, secure its future in a post-oil world, and carve out a unique role as a global trade and logistics hub. But the UAE’s trade push is about more than just economics – it represents a sophisticated exercise in soft power projection, one that seeks to enhance the emirate’s diplomatic clout and strategic autonomy in an increasingly multipolar world.

The CEPA strategy

CEPAs form the cornerstone of the UAE’s economic diplomacy. These wide-ranging trade pacts go beyond traditional free trade agreements, encompassing investment, services, and digital commerce.

Nicolas Michelon, CEO of Asia Intelligence Advisory and Editor of Asia Power Watch, frames the CEPA drive within a broader geopolitical context. “The UAE’s recent drive to enter into CEPAs with many new partners should be seen as being part of a wider strategy to assert Smart Power, at the intersection between Hard Power – military and economic power – and Soft Power – culture, technology, diplomacy, for example,” he told Arabian Business.

This multifaceted approach has allowed the UAE to leverage its strengths across various domains, from its world-class logistics infrastructure to its growing technology sector and its early nationwide embrace of AI.

“In a context of deep reshuffling of geopolitical and geoeconomic cards, strategic re-alignments and new economic and technological paradigms, it is crucial for a nation like the UAE to project Smart Power beyond the MENA region and beyond its own traditional alliances – with the US and Europe particularly,” Michelon explained.

The UAE has moved swiftly to implement this vision. Since signing its first bilateral CEPA with India in February 2022, the UAE has moved swiftly, signing and enforcing agreements with Israel, Indonesia, Turkey, Cambodia, and Georgia. Negotiations are underway with several other nations.

The US-China divide: A balancing act

A key driver of the UAE’s CEPA strategy is the desire to maintain strategic autonomy in an increasingly polarised global landscape. As tensions between the United States and China continue to escalate, the UAE is carefully positioning itself to maintain productive relationships with both superpowers.

“Priority remains playing a balancing act between the US and China without closing any door,” Michelon explained.

“The latest example of AI investment fund G42 having to divest from its Chinese AI startup investments under Washington pressure is a stark reminder that sitting on the fences will not always be viable.”

Maintaining ties with a wide range of nations and diversifying its economic partnerships have helped the UAE reduce its vulnerability to geopolitical pressures and maintain its strategic flexibility.

In this context, the CEPA strategy serves a dual purpose. “The CEPAs the UAE is signing then, in Latin America and beyond, represent a new geoeconomic strategy to remain neutral and non-aligned,” Abishur Prakash, Founder of The Geopolitical Business Inc. said.

Latin America and Africa in focus

The UAE’s recent trade push has placed particular emphasis on regions that have historically been underserved by Gulf investors: Latin America and Africa. This pivot reflects both economic opportunism and strategic foresight.

According to Michelon, the rationale behind this focus has been the energy transition and decarbonisation, as well as the Gulf nation’s pursuit to becoming a hub for “disruptive innovation.”

“[This requires] access to critical raw materials that the UAE needs to obtain from third parties, many of which are to be found in Africa and LATAM,” he said.

The urgency of this push is underscored by growing regional competition, he believes.

“Other neighbouring countries are pushing for the same strategy and the competition is rife for access to these resources. Saudi Arabia is expanding its reach in those same geographies, and so are Qatar, Turkey and Iran. The UAE cannot afford to lose that race,” Michelon said.

Recent trade missions highlight the UAE’s commitment to these regions. Dubai Chambers recently embarked on a trade mission to Senegal, a mission which Arabian Business was able to gain firsthand insight into. The delegation, comprising 13 companies from diverse sectors, engaged in over 150 bilateral business meetings in Dakar to explore opportunities in agriculture, healthcare, energy, and tech – among many others.

On the sidelines of the trade mission, Dubai Chambers’ President and CEO, Mohammed Ali Rashed Lootah, emphasised the growing ties between Dubai and Senegal, revealing that non-oil trade between the two hit $942 million in 2023, up 17.7 percent year-on-year.

“[This shows] an increased interest between the private sector in Dubai and in Africa,” he told Arabian Business at the time.

The mission highlighted Dubai’s role in supporting Senegal’s development ambitions. DP World’s $1.1 billion investment in a new deepwater port and special economic zone outside Dakar was touted as “the largest private investment in the country’s history.”

Senegal’s Minister of Industry and Trade, Serigne Gueye Diop, welcomed the UAE’s engagement. “One of our ambitions is to enhance the promotion of Senegal as an investment destination and to better showcase our products and strengths internationally,” he said in an interview with Arabian Business in Dakar last month.

Morocco as a gateway to North Africa and Europe

The trade mission’s subsequent stop in Morocco underscored the strategic importance of North Africa in the UAE’s economic calculus. Morocco, with its proximity to Europe and established trade links, represents a key gateway for UAE businesses looking to expand their reach.

The scale of UAE investment in Morocco is significant. As revealed exclusively to Arabian Business by Lootah last month, Dubai firms invested $2.1 billion in Morocco over the past decade. This positions the emirate as a preeminent source of foreign direct investment for the North African country.

“Morocco has always been considered as a gateway to the African market and southern Europe,” said Lootah at the time.

The timing of this investment push is noteworthy, coming as Morocco prepares to host major international sporting events, including the 2030 FIFA World Cup. Emirati firms are poised to play a crucial role in developing the infrastructure and hospitality facilities required for these global showcases.

“When you think of partners, especially when it comes to Morocco, the top country that pops up is the United Arab Emirates,” said Anas Guennoun, Vice President of CGEM and new head of the UAE-Morocco Business Council, on the sidelines of an MoU signing in Casablanca last month.

“We are targeting to double the number of tourists to reach 25-26 million by 2030…Dubai is a shining example and has become a hub for startups, the digital economy, and technology industry, so we would love to see how we can build an IT ecosystem in Morocco,” he added.

Hassane Berkani, President of the Casablanca Chamber of Commerce, Industry, and Services, also highlighted the depth of UAE-Morocco ties. “This relationship, which dates back to the time of Sheikh Zayed and King Hassan II, has opened the door for extensive collaboration in a number of fields.”

With the FIFA World Cup approaching, Berkani expects more UAE businesses to operate in Morocco over the next few years.

Soft power, beyond economics

In September 2017, the UAE launched its Soft Power Strategy to enhance the country’s global reputation by showcasing its identity, heritage and cultural contributions. The strategy focuses on four key objectives: developing a unified direction across various sectors, promoting the UAE as a regional gateway, establishing it as a cultural and tourism hub, and highlighting its modern, tolerant character. Its six pillars include humanitarian, scientific, and economic diplomacy among others which form a framework for the UAE’s diplomacy efforts.

Recent data from Brand Finance’s Global Soft Power Index 2024 indicates these efforts have yielded significant results, with the UAE climbing eight ranks to 10th place since 2020, demonstrating marked improvements in influence, reputation, and international relations.

While the economic benefits of the UAE’s trade strategy are clear, its soft power implications are equally significant. By positioning itself as a neutral, business-friendly hub in a relatively turbulent region, the UAE is enhancing its diplomatic leverage and global standing.

“The UAE is positioning itself as a global trading hub at a time when the international trading system is undergoing a politically-induced disintegration,” said Economist Omar Al Ubaydli, director at Bahrain-based think tank DERASAT.

“Its key selling point is that it maintains good relations with all major players and that it has a combination of high-quality infrastructure and a business-friendly commercial environment.”

This approach is particularly appealing to nations in the Global South seeking to avoid entanglement in great power rivalries, Al Ubaydli noted.

“After centuries of colonialism and neo-colonialism, Latin American countries prefer to do business with countries that treat them as legitimate and equal partners who are not to be dictated to under any circumstances, and the UAE fits that favourable mold,” he explained.

The role of state-affiliated companies in projecting UAE soft power cannot be overstated, Michelon said. “Those companies, together with AD Ports Group in integrated logistics, the Edge Group, a defense consortium, and Abu Dhabi’s Sovereign Wealth Funds are spearheading the projection of UAE’s Smart Power globally by investing massively overseas and attracting investments into the country.”

As a result, the UAE has topped foreign investment inflows in the Arab world, attracting more than half of the region’s investment opportunities. The country attracted $30.7 billion in FDI inflows last year – a 34 percent increase, according to a recent UN Trade and Development report.

The UAE’s recipe for diplomatic success

“The UAE is creating its own corner, drawing nations into an Emirati orbit,” said Prakash, highlighting the country’s growing influence on the world stage.

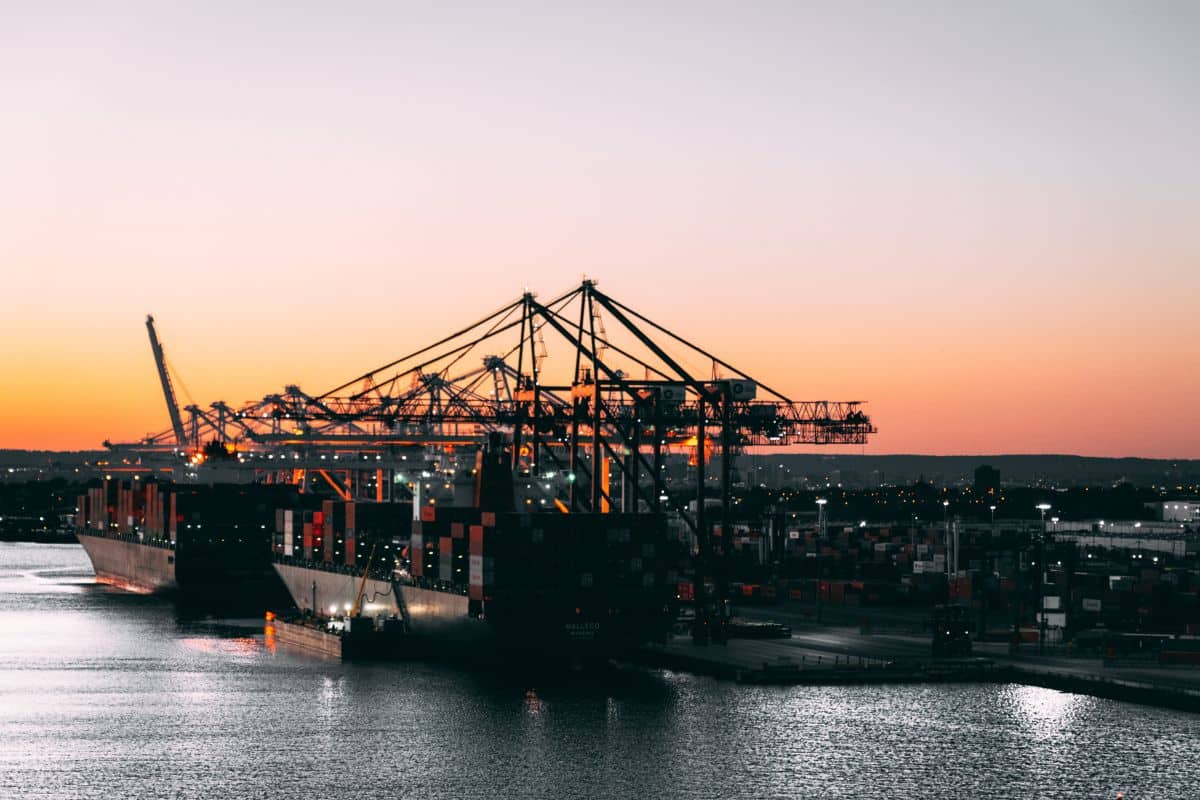

According to Michelon, Dubai’s emergence as a global business and trade hub can be attributed to several key strategic advantages. The city’s central location between the bustling markets of Asia-Pacific and Europe, coupled with its proximity to critical shipping routes such as the Arabian Gulf, Bab el-Mandeb Strait, and Suez Canal, provides unparalleled connectivity.

“The UAE’s recipe for success is not easy to replicate,” Michelon noted, citing that the country’s reputation for safety and stability as a crucial factor in its attractiveness to businesses and investors.

The Numbeo 2024 Safety Index ranks Abu Dhabi as the safest city in the world, with Dubai following closely at fourth place. This reputation for security is further bolstered by the UAE’s significant improvement in the Global Peace Index, where it rose 31 places to rank 53rd globally in 2024 – the largest improvement in the region.

Dubai’s transparent business environment and strong rule of law have further positioned it as a highly attractive destination for global investment. The emirate’s commitment to economic diversification, coupled with its world-class infrastructure and business-friendly policies, has made it a magnet for international companies and entrepreneurs.

“There are only a handful of places like these left in the world,” said Michelon, highlighting that Singapore – which is often drawn as an example to UAE – has now started to suffer from prohibitive operating costs and worrying China overreach.

This unique combination of factors, supported by some of the world’s most powerful Sovereign Wealth Funds, has given the UAE a significant edge in global trade and diplomacy.

“The UAE can therefore project itself as one of the few remaining safe havens that corporates and investors so direly need in these times of heightened geopolitical uncertainty. And this safe haven image is the main pillar of the Emirates’ soft power strategy,” said Michelon.

While its trade-driven soft power strategy has shown early promise, it faces an uncertain global economic landscape. Persistent inflationary pressures and geopolitical tensions threaten to disrupt trade flows. The country’s ability to navigate the complex interplay between economics, diplomacy, and geopolitics will determine the long-term success of its soft power strategy.

The UAE’s unique diplomatic approach reflects “a strong will for power, for influence, based on proposing a constructive approach to partnership and an admirable sense of timing,” according to Michelon.

Looking ahead, the UAE’s future will be determined by its ability to remain resilient and maintain its soft power advantage through diplomacy, trade, and a business-first approach. As geopolitical tensions rise and the global economic order shifts, the UAE’s strategy of creating its own sphere of influence while maintaining neutrality will be put to the test.